Buying a house is thrilling especially when it’s for the first time! The learning curve is steep, but doing a little financial homework can help you navigate the system and set you apart from the competition. Here are six first time home buyer tips and tricks to ensure your home buying experience goes smoothly.

First Time Home Buyer Tips & Tricks

Check your credit

As a first time home buyer, the more you know about your own financial situation the better. Your credit score is one of the most important factors in determining if you qualify for a loan. Simply, the higher your credit score, the higher the chances you qualify for a loan and the lower your interest rate on your mortgage. Visit Credit Karma for a free credit report that determines your overall score as well as areas of strength and opportunity.

Research agents

Not every agent is the best agent for you. Talk to your friends and family and see who they’ve had luck with in the past. You want your agent to be in your corner at all times, giving you confidence in the home buying process. Having a great agent will ensure the success of your transaction and give you peace of mind. Additionally, a great agent will have experience with first time home buyers like yourself and can have ready to go solutions for any bumps along the way.

Check out the neighborhood

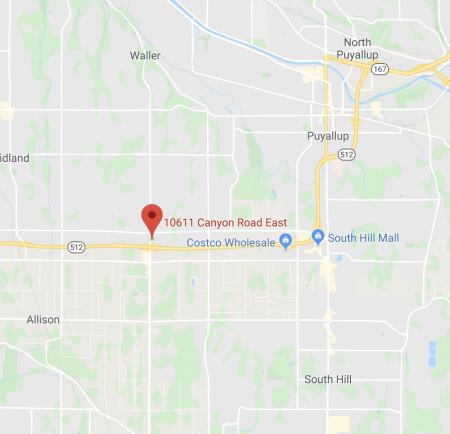

Before you put an offer on a home, check out the neighborhood. A good rule of thumb is to avoid buying the nicest house on the block as it won’t appreciate as well. Remember, you’re not only buying a house, you’re also committing to the neighborhood, the block and general surroundings. Explore the closest grocery stores and shopping centers and decide if that commute is one you want to make on a weekly basis.

Schedule a home inspection

Just because the home you’re about to buy looks like it’s in good condition, it never hurts to get a home inspection. By having a professional inspector come to the skeleton of the house, you’re able to catch any red flags early on. For example, if the home inspector finds an issue with the roof, you can show the inspection report to the home seller and ensure that they fix the issue before you move in. Home inspections are generally under $500 and can save you thousands of dollars to fix issues you didn’t even realize where present in the house.

Be open-minded

As a first time home buyer, it’s easy to find what you think is your dream house and turn away any other options, passing up some hidden gems. Make a list of your non-negotiables and nice-to-haves so you don’t turn every bullet into a non-negotiable. Additionally, when homes in open houses are staged, they tend to complete your vision of living in the home. Don’t let this prevent you from buying an unstaged home, pay attention to the floor plan, moldings, and size or rooms.

Save up for closing costs

It’s not just the down payment you need to save up for when buying a home. You’ll also need to account for the closing costs, transfer tax, escrow fees and prepaid interest. By anticipating these costs when you first analyze your budget, you’ll avoid being blindsided by the costs at the end of the home buying process.

You may also like: 7 Steps to Buying a Home in Pierce County.